Boost Your Income For Christmas Using Your Smart Phone

Christmas time is a slow period for the housing market as would-be buyers and investors save for the holiday season. If you’ve been saving your first home deposit or getting ready to purchase an investment in the new year, you’ll want to have some extra income for those incidental holiday expenses.

Here’s 7 Positive Tips to make some money on the side leading into the new year:

-

Small Change Investing - Acorns or First Step

Using apps you can get on your smartphone, give yourself the Christmas gift of investment. You can link this app to your credit or debit cards and bank account, and it’ll round up the cents from each purchase to a whole dollar. Slowly but surely you’ll be able to build a small savings balance. From time to time, Acorns even partners with other businesses who'll contribute towards your investment fund when you use their services:

At the least it’s a forced form of saving, and you’ll be surprised how quickly the balance can accumulate.

What’s the cost? Acorns charge $1.25 per month for accounts under $5000, which is $15 per year.

There's two automated investment apps available now in Australia:

First Step

Acorns

The small change is invested into an Exchange Traded Fund, which is a

managed fund portfolio spread across different investments and stock

markets. You can choose from 5 different levels of risk to suit your

personality and situation. If you’re not sure, keep it conservative.

At the least it’s a forced form of saving, and you’ll be surprised how quickly the balance can accumulate.

What’s the cost? Acorns charge $1.25 per month for accounts under $5000, which is $15 per year.

There's two automated investment apps available now in Australia:

First Step

Acorns

The small change is invested into an Exchange Traded Fund, which is a

managed fund portfolio spread across different investments and stock

markets. You can choose from 5 different levels of risk to suit your

personality and situation. If you’re not sure, keep it conservative.

Start now, and reap the rewards.

The sooner you start the better. Assuming an annual rate of 10%, if you were to invest $2000 per year for just 6 years from age 19 to 25 (this is just $14,000 in total) you’ll have $931, 000, assuming annual return of 10%, you’ll have $931,000 by the time you’re 65. Compare this to the situation where you start later - say you invest $2000 per year from age 26 to age 65 - even though you’re putting more money aside ($80,000 in total) with an annual return of 10% you’ll end up with $894,000 at age 65. That’s the power of compounding interest. It's never too late to invest, so start now so you won't have regrets later.

-

WiFi sharing

In September a clever company in Melbourne, Velvet Wi-fi launched a device that enables you to share your home wi-fi and be paid for data you wouldn’t have used otherwise. The device has a range of about 30m, depending on the obstacles that are in the way. You can set the amount of data that you want to share each month, and users just pay as they go.

It’s $60 to buy the device, which you’ll agree will pay for itself in no time, especially if you live in a busy area or even an apartment block where neighbours might not already have wifi internet themselves.

You’ll need to check your telco contract to find out if you can take advantage of extra data you don’t use by earning $3.36 per GB shared.

The device has a range of about 30m, depending on the obstacles that are in the way. You can set the amount of data that you want to share each month, and users just pay as they go.

It’s $60 to buy the device, which you’ll agree will pay for itself in no time, especially if you live in a busy area or even an apartment block where neighbours might not already have wifi internet themselves.

You’ll need to check your telco contract to find out if you can take advantage of extra data you don’t use by earning $3.36 per GB shared.

-

Invest in your health

-

Sell your Smartphone photos

Anyone can take good quality photographs as phone camera technology improves year on year. If you’ve got an artistic flair and a good eye, you may be able to sell your photos as stock images. Here’s a couple of sites where you can try uploading your images: Foap

Scoopshot

-

Earn money by being online

Simply by being online doing things you’ll do anyway - like watching videos, playing games, searching the web, you can earn gift cards towards major retailers. Try Swagbucks to get started - they have an easy app you can download to watch video from.

-

Give your opinion

Through online platform Mindswarms you can participate in digital market research for topics you’re knowledgeable about. If you’re the right fit and you complete a video survey, you’ll be paid through your Paypal account. -

Become an English language tutor

To be a community tutor on Italki you don’t need to have professional teaching qualifications. Here’s a couple of sites you can check out: Italki Cambly Italki get better reviews from users, and will require a little more work to set up. You record a short video about yourself, and students can then choose you to be their tutor. The main difference between Cambly and Italki is that Cambly is less structured - you're not given a lesson plan or a topic to talk about. This makes it a bit harder to start a conversation as the student may not have English language knowledge on the topics you choose. If you have a second language though, this app could work really well for you!

This makes it a bit harder to start a conversation as the student may not have English language knowledge on the topics you choose. If you have a second language though, this app could work really well for you!

Maintaining your fitness and health, keeping stress levels low so you can maximise your earning potential rather than spending time and money on illness is one of the soundest investments you can make in your own future.

It may require some careful thought about how you spend your time and your weekends, but it’s an investment in something that money can’t buy!

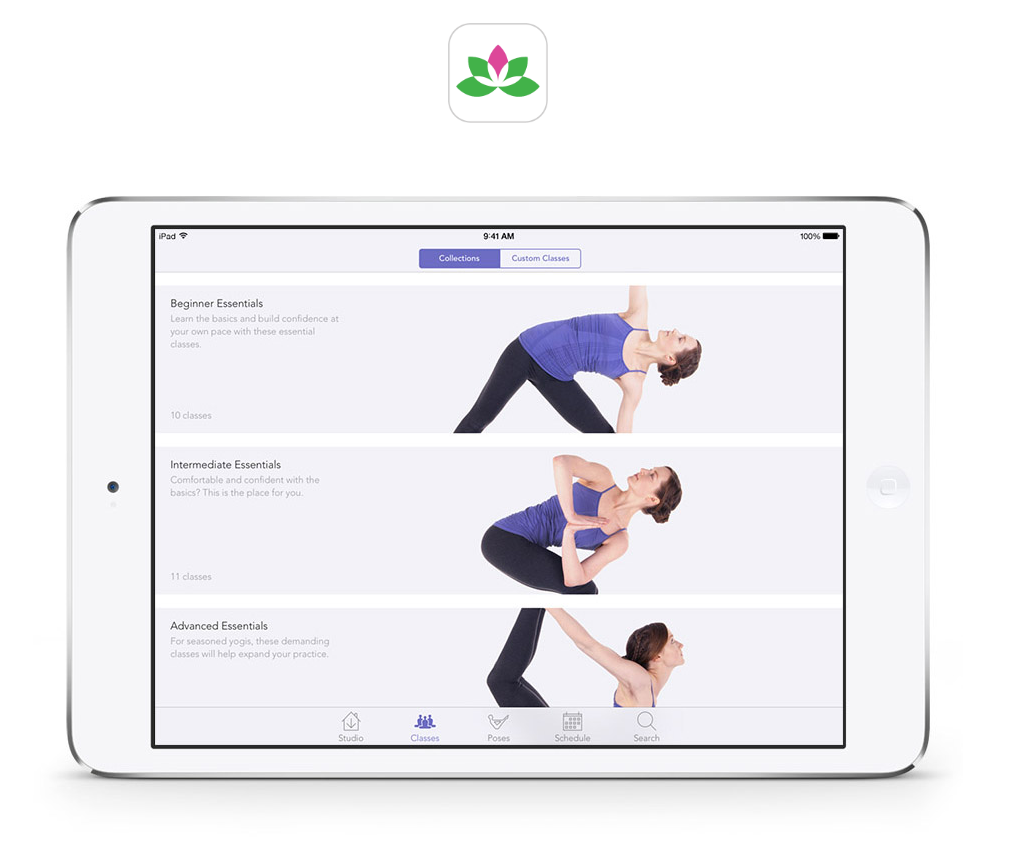

It might mean joining a gym, yoga classes, learning to meditate, or downloading some exercise and relaxation podcasts or videos you can use to get some time out.

Yoga Studio is a great app you can use at home to build your own practice. It's perfect for beginners too.

If you're looking to up the intensity, try PTinMyPocket, designed by body-weight training expert and mum of Olympic athlete Charlotte McShane. You'll find a heap of free HIIT workouts you can do without any equipment.

Use your phone to earn income in the new year.

As you can see, just using your smartphone you can earn a few extra dollars to cover Christmas expenses in the free time you usually spend trawling Instagram or Facebook.

If you’re smart this Christmas, you’ll avoid going into debt to provide gifts for your family and friends, and give yourself a strong financial start to the new year.

We wish you all a Merry and Safe Christmas this year and hope you have a fantastic year in the coming 2017