Would Donald Trump Get a Positive Home Loan?

Few people are as obsessed with their net worth as former Miss Universe pageant owner and American presidential candidate Donald Trump. From those early days of being a college graduate with a paltry $200,000 to a consistent also-ran in the Forbes 400 with paltry few billion, he’s been keeping score as well as his continued sarcastic efforts to align Obama and Clinton as ISIS creators.

Trump entered the 2016 US election campaign with two claims

- He’s worth in excess of $10 billion

- He will ‘Make America Great Again’, helping to create wealth for all Americans

“After all”, he says, “you have to be wealthy in order to be great.”

If one’s greatness is measured by wealth, Donald Trump is by far the greatest candidate for the American presidency this year, possibly ever in terms of ‘I can’t look away due to FOMO’.

Thankfully, greatness isn’t measured as such (co-incidentally, neither is class), but his money does run into the billions.

His personality, however, runs into the tens of dollars.

With Trump’s financial history open for all to see (income tax excluded), we thought it would be worth understanding if he could actually qualify for a mortgage. Pre-approvals aren’t sold on personality/greatness alone, so we spent some time gathering the important bits of his story, but in his phrasing.

The Man with Unshakeable Self-Belief

Trump’s assessment of his personal net worth, or the worth of any of his key assets, is a reflection on his mood at the moment he is asked, his self esteem rather a reflection of the market value or the equity existing in the property.

In 2006, he even filed a lawsuit (which he lost) against Warner Books for alleging he was worth just $150-$250 million, rather than the billions he claimed at the time.

Task One: Unearth the Real Financial Situation

One of the first tasks any broker will evaluate is a client’s financial situation. There’s two key parts to this - we’ll look at their current assets and any deposit that they already have saved.

The second part is looking at their income, and the income they can rely on in the future.

Income will determine the size of the mortgage that they’ll be able to service. The deposit or equity they have available in current assets will determine whether they’ll need a guarantor loan or if they’ll pay lenders mortgage insurance.

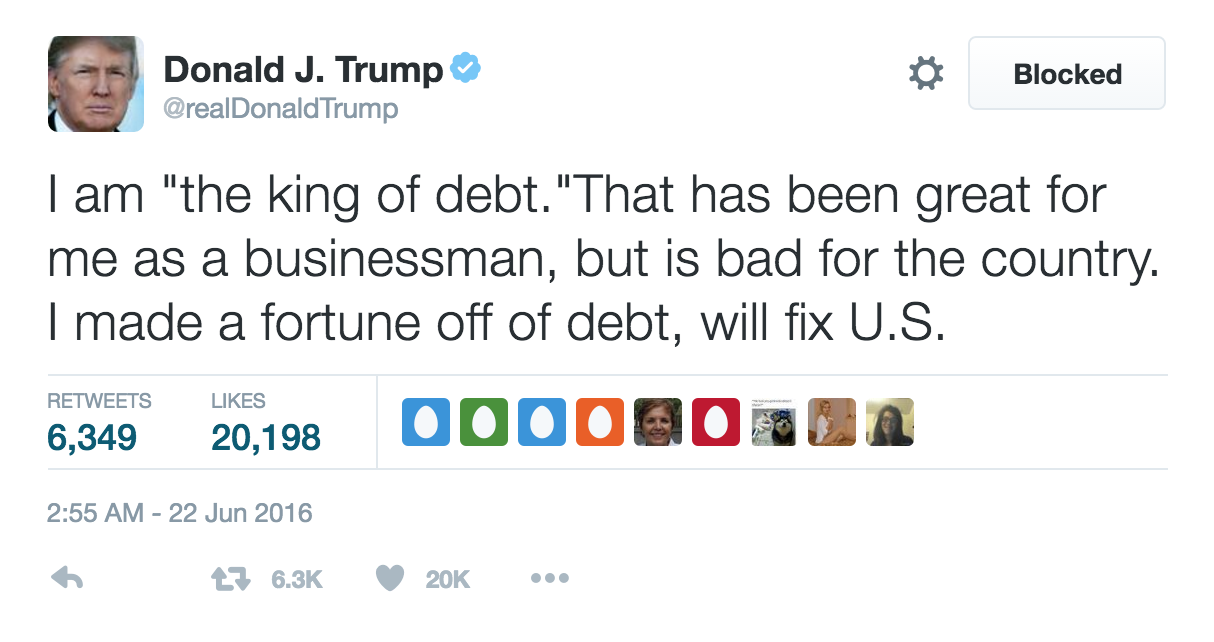

In order to lend on top of his existing $503 million loans and mortgages, a broker would look to see what he really owes. He’s been known to inflate his revenue and income in his campaign filing reports,

not to mention the ongoing discourse with Forbes over exactly where he

fits into the Forbes 400, which is obviously a sign of how great a

person is (coincidentally, Bill Gates is the greatest person on

earth...and that wouldn’t be too far from the truth with his

philanthropic work).

In order to lend on top of his existing $503 million loans and mortgages, a broker would look to see what he really owes. He’s been known to inflate his revenue and income in his campaign filing reports,

not to mention the ongoing discourse with Forbes over exactly where he

fits into the Forbes 400, which is obviously a sign of how great a

person is (coincidentally, Bill Gates is the greatest person on

earth...and that wouldn’t be too far from the truth with his

philanthropic work).

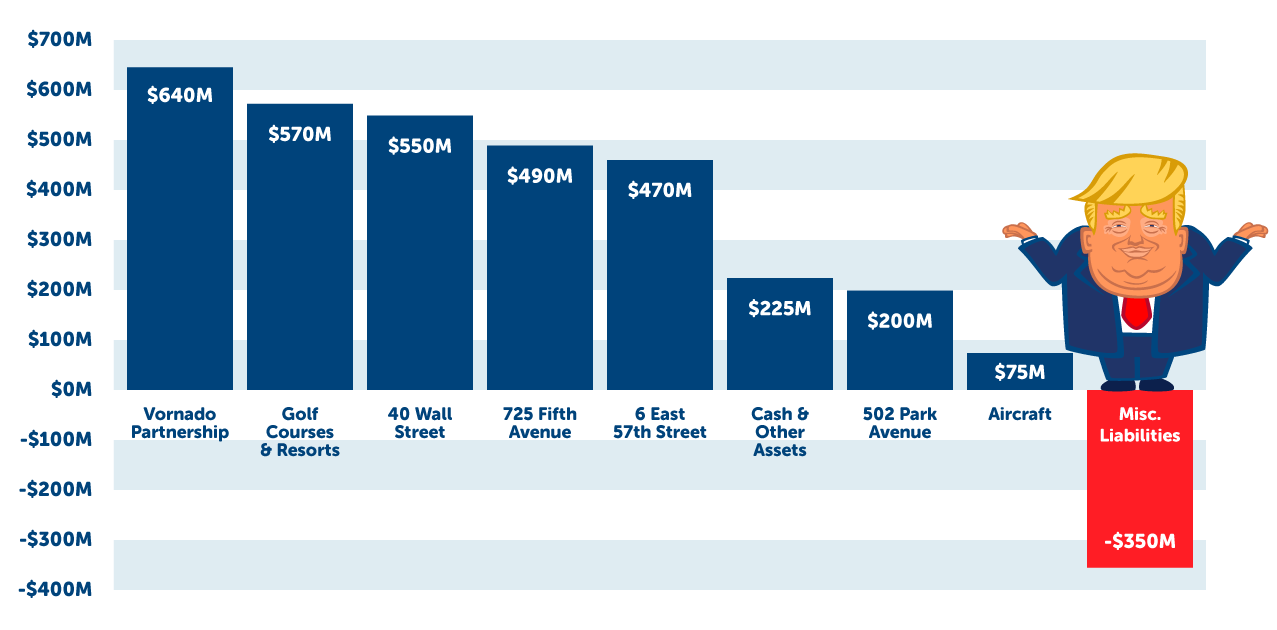

Donald Trump’s True Net Worth

Fortune Magazine dug into Trump’s undisclosed business income and found that between his three avenues of business, he had something similar to the following:

- $235 million in commercial rents

- $63 million in royalties for his personal brand

- $400 million in other income - sales of condos, golf course revenues

With a total revenue of around $698 million - let’s call it $700 million because we're really Positive people - and assuming he has a very efficient operating margin, salaries, upkeep and expenses would leave around a 32% profit client (based on a median of property giant Vornando and Boston Properties)

$224 million annually in operating profits is the outcome.

Right now, Trump’s situation is looking pretty healthy - but during the last financial year, he managed to increase his debt, with Fortune estimating Trump’s annual interest payments would be around $47 million.

After tax (we’ll assume 15% - a low rate for a billionaire), once he’s paid the interest in the mortgages and loans, his annual after tax income comes to about $150 million. Is that more than the entire economy of micronations? Probably, but according to three leading financial publications - Bloomberg, Fortune and Forbes - publicly available information sets Trump at between $2.9 billion and $4.5 billion, with liquid assets around $300 million.

Task Two: Assess Mortgage Repayment History

When you apply for a mortgage, your broker will ask whether you’ve got any missed repayments on past loans. With missed payments on bills or on your credit card, you’ll fall into the ‘non-conforming’ mortgage sector, which means you’ll get a loan with a specialist lender, rather than a major bank - you’ll usually pay a slightly higher interest rate too. If you have a good repayment history, you’re going to get better loan structure and terms.

How Does Trump’s Repayment History Look?

Well,

if appearances were everything, he wouldn’t have to bother with

repayments and the banks, ‘the very best banks’, would just let it

slide. However, that’s not a reality, and former Security Pacific CEO

Robert Smith details just one example in his 1999 book, ‘Dead Bank Walking’.

“Trump sought a $50 million loan from the Los Angeles branch in 1989 to rejuvenate the old Ambassador Hotel, famous as the location where Robert F. Kennedy was assassinated in 1968.”

Smith was skeptical: “When a guy like Trump gets into trouble, he can no longer borrow because no institution will lend to him.” Smith explained this to his colleagues, trying to convince them not to be overawed by Trump’s charisma.

“As a lender, no matter how glamorous the person on the other side of the table is, you look to the borrower to have both primary and alternate sources of repayment. While Trump presented a financial statement with many million dollars of net worth, the ability of him to bail even this one project out was limited.”

Smith’s colleagues rejected the warning and loaned The Donald $10 million. Just two years later, as the property market swooned in the early 90s, Smith was proven right and the bank wrote off the entire $10 million mortgage.

Based on just this one piece of Trump’s mortgage history, he’d definitely fall into the non-conforming category for his next mortgage pre-approval.

Task Three: Assess Banking History

When assessing an applicant for a mortgage approval, a mortgage broker needs to see 3 months of bank statements of the applicant, and repayment history on any loans they already have, including credit cards. What they are looking for is that the applicant has at least 5% of the purchase price of the property they want the mortgage for, in genuine savings that have been held for 3 months

They’ll also check to make sure that you make at least the minimum credit card or loan repayment on time every month.

At Positive Home Loans, brokers will also look at your bank statements to make sure that the mortgage repayment aren’t going to stretch you too much financially, based on your current spending habits. They’ll also look for any evidence of gambling or anything else that could compromise your ability to meet mortgage repayments on time every time.

Trump’s Banking History

Trump’s personal finance disclosure forms show that he currently owes at least $250 million to banks for various real estate projects. We’d need to be certain he could afford another loan on top of the repayments he’s already obligated to make.

Whether Trump burned his bridges with the big banks he dealt with on Wall Street in the 1980s and 1990s over a 2005 Chicago property loan from Deutsche Bank, or whether he’s making smart business decisions by going with the lowest interest rates that can’t be found from major investment banks, Donald doesn’t have much to do with major banks which require collateral for loans and can’t offer the super low (2%) interest rates and personal guarantee that the private banks allow.

Would the four-time bankrupt Donald Trump qualify for a Positive Home Loan?

Without any ‘fixed’ figures - in this context, not the ‘fixed’ generally associated with Trump - the educated guesswork and ‘back-of-the-envelope’ calculations suggest we’d be inclined to say no. We’d rather stay clear of litigation (a recurring fate of anyone getting close to Trump), so let’s just say that there may be some lenders out there ready to give Trump a pre-approval!