What is Negative Gearing?

The Changing Position of Government

The Government Budget, released on 3rd May 2016, indicates that our current government are not intending to make changes to the negative gearing tax benefits currently available to Australians with investment properties. However, with the election looming, the future of the Australian tax system is still in a bit of uncertainty.

The reasoning behind the current debate around negative gearing is that negative gearing does encourage over-investment, and has resulted in the over-leveraging of Australia's housing market. This was the conclusion of the Financial System Murray Report.

Over the last 30 years, house prices have been increasing at a much greater rate than wages, making it more and more difficult for first home buyers to enter the property market. While this has not been caused by any one factor, housing affordability has been brought to the attention of media and politicians as the debate on the need for reform of housing policy heats up.

Negative gearing for investors explained

Once you understand the relationship between negative gearing and your property investment, you'll be prepared to ride the waves of government policy change.

Generally speaking, property is a safe investment that generally experiences capital gain if you can hold it over the long term. A lot of people buy investment property in order to fund their retirement. Self-employed people might opt to purchase property instead of investing in superannuation. It requires less micromanagement than investment in shares, and its the most popular choice of Australians.

To purchase an investment property you would usually take out a mortgage with a lender, with the property acting as security for the loan. Borrowing to make a large purchase is called ‘gearing’. By borrowing money to buy an asset, such as an investment property, you can make a much bigger capital investment than if you just used the money you’d saved.

This maximises the potential return on investment, as there is a bigger capital base invested. It also exposes you to a greater risk if the investment decreases in value, as you still have to repay the capital and interest.

‘Negative gearing’ occurs when the repayments on the mortgage for the property that you buy are great than the rental income that you receive from that property.

Negative gearing has been around for a long time - it was first introduced in Australia in the 1936 Tax Assessment Act.

In 2013, there were 1.3 million Australians with a negatively geared property.

Real estate is the only investment market where you can claim your investment losses against your personal income. The effect of negative gearing is that it can push people into a lower tax bracket, significantly reducing the amount of tax they pay while still enabling the property owner to increase their net worth through capital gains of the property value.

Will my investment be worthwhile if negative gearing is abolished?

Even without the tax breaks, a negatively geared property, carefully calculated to be affordable and budgeted for within your annual income, is going to be a worthwhile investment in the long-term. House prices will generally rise consistently, allowing you to realise a capital gain when you decide to sell.

The end of negative gearing will place more importance on carefully selecting an investment property that will realise real capital gains, rather than focusing on the shorter term tax benefits that you can currently get from owning a negatively geared property.

If you are intending to invest in a high capital growth area and negatively gear a property, you need to be able to afford the losses you will make when the rental income doesn’t cover your mortgage repayments, strata fees, repairs and so on.

For negative gearing to be worthwhile, the capital gain - less the capital gains tax payable on sale of the property - during the period that you own the house will need to be greater than the losses that you make due to the differences between rental income and the costs (interest and expenses) that you pay on the property during the period you hold it for.

You only really find out whether you’re making a financial gain when you actually sell the property. This will call for investors to be more careful, undertaking proper research and financial advice before they purchase an investment property.

Investing is about making a profit, not about the strategy you use to achieve this goal.

With property investment, you’re focusing on the long-term, not the short-term benefits. The proposed changes to negative gearing will encourage property investors to be more cautious.

What would the removal of negative gearing mean?

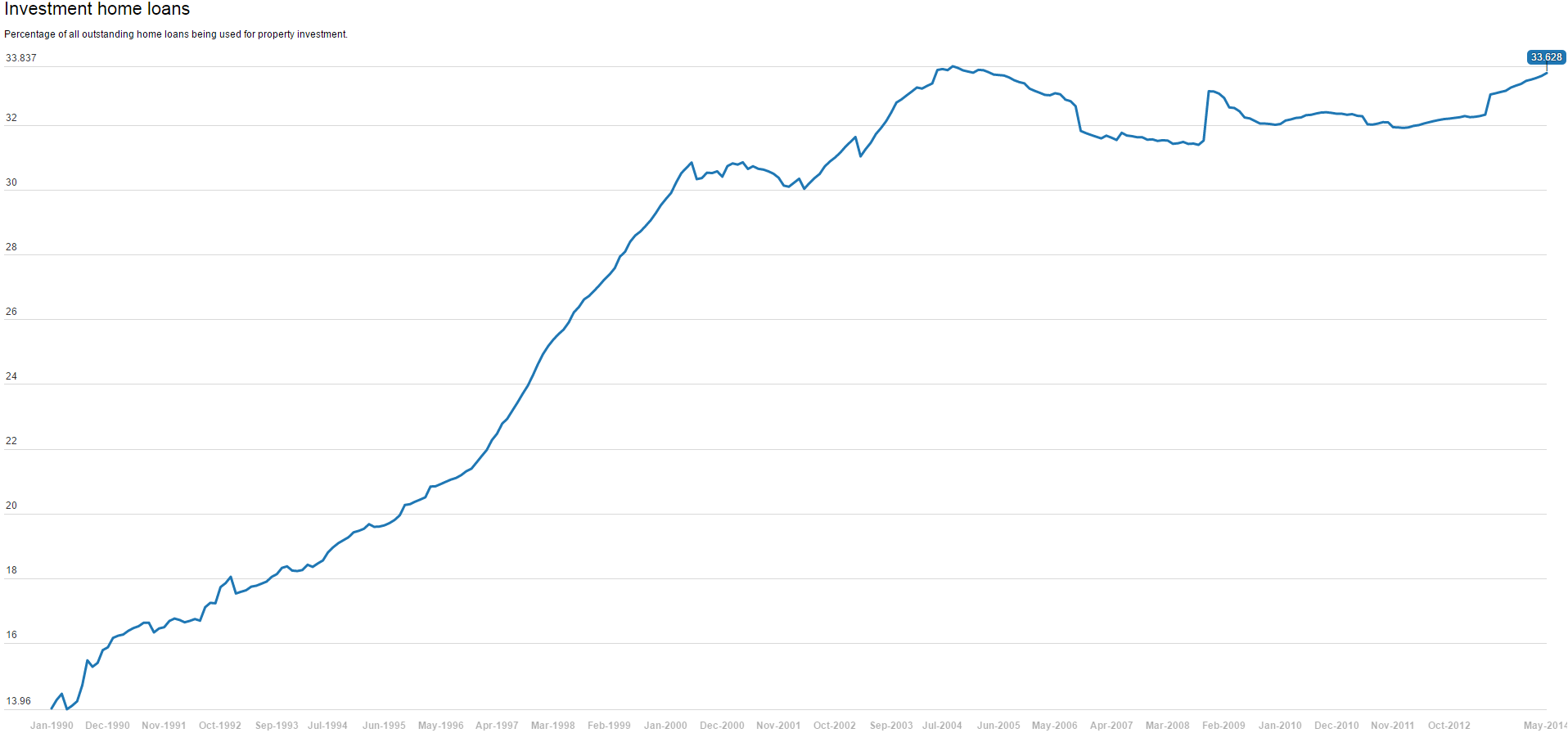

One-third of all outstanding mortgages are held for the purpose of property investment, a huge increase since 1990 when only 14% of home loans were investment property loans, according to data from the Reserve Bank of Australia.

This increase in property investment coincides with the 50% discount to capital gains tax, which replaced the indexation tax, introduced by the Howard government in the late 1990’s.

The removal of negative gearing will mean that investors will undertake less speculative property investing. If investors can’t rely on the tax cuts and a bigger tax return, they face responsibility back to ensure that their cash flow is good, and they can maintain the repayments and upkeep of the property if it doesn’t provide an income stream.

An Australian example of an investment gone sour

Kate and Matt Moloney, voted Property Investors of the Year by Your Investment Magazine in 2012, but then became bankrupt in 2016, are an example of how important to be careful not to over-extend your financial position, and to diversify your investments.

Investing in a mining town involves a high degree of risk, as these properties are generally in areas that people will live - and pay high rents due to limited accommodation options - only while the mine is making money and the jobs are available.

Due to the usually isolated location of these properties, once the jobs start to wind up, you’ll struggle to find tenants, and the value of the property will fall as people move away from the once boom town to seek employment and an ideal lifestyle elsewhere.

If you chose to make this kind of investment you want to be confident that you’ll know when to sell, and that the purchase fits in with your overall investment strategy.

So how can you make a smart property investment to increase your wealth, regardless whether government policy changes?

Making wise decisions about property investment

We asked our experienced mortgage broker for some key tips to ensure that you make an investment that you can afford. Here are his suggestions:

"The first thing about buying an investment property is that it should not be an emotional decision."

"Too many people spend too much on an investment property because they get emotionally involved in the purchase, and they’ll choose a bigger backyard, or extra lounge room. These are features that increase the cost of the property but won’t increase the rental yield."

"When you buy an investment property, you should put yourself in the shoes of a renter. Select a property that will be appealing to the broadest range of people possible - you want plenty of storage space, car parking, a shed, low maintenance garden. You may look to add value by renovating, constructing a carport or instaling a modern kitchen."

How do you get started?

- Set Your Goals

- Know Your Finances

- Do Some Research

- Choose your area and get a home loan pre-approval

- Get expert advice

Knowing exactly what you want to achieve will enable you to have a clear focus and, with your financial advisor or accountant, create an investment plan to achieve those goals.

Write out a statement of your financial position - all assets and liabilities. You’ll want to create an income and expenses document, being totally realistic about your outgoings. This is also a good opportunity to review your household budget.

This process will help you to see how much money you have to invest, and it will also help you to set a practical goal. If you’re asset rich but income is tight, you’ll want to find a property likely to have a higher rental income.

Allow yourself 6 months or so to find out about the property market, what’s around and what strategies could work for you. This could save you money in the long run.

It’s also a perfect chance to practice putting away a sum each pay cycle that you’ll need for the costs and repayments on your investment. Getting a buffer in place will give you security when you commit.

With a home loan pre-approval, you have an exact budget, and you're ready to move straight away if you find the right property to purchase.

Start to look at houses and really get to know the area that you’ve chosen to invest in. Remember, there’s no rush. Take your time to get to know some real estate agents and let them know what you’re looking for.

Don’t hesitate to ask for help - particularly from your accountant, a property valuer, or a buyer’s agent.

If negative gearing is removed by a labor government on July 2017, this will have no effect on your borrowing power or ability to obtain a home loan for investment.

There has been a lot of media on whether the abolishment of negative gearing will cause house prices to fall, allowing potential first home buyers to move from renting to home ownership. There has also been speculation regarding whether rent will rise due to investors leaving the property market and fewer available rentals.

If you're saving to buy your first home and you're worried about an increase in rent making it more difficult to save up your deposit, there's no cause to be concerned. This article explains that the market will remain pretty stable.

If Labor's proposal is adopted after the next election, and you are planning to buy an investment property after July 2017, you'll be able to benefit from negative gearing if you buy a brand new property, the tax breaks just won't apply to existing properties.

Before purchasing an investment property it is essential that you speak to your accountant and get reliable financial advice.

For more information about property investment, read our property investment guide, or if you are ready to find out what options you have to purchase an investment property, get in touch with a mortgage broker who will be able to outline your options for moving towards a pre-approved property investment loan.